- cross-posted to:

- news@lemmy.world

- cross-posted to:

- news@lemmy.world

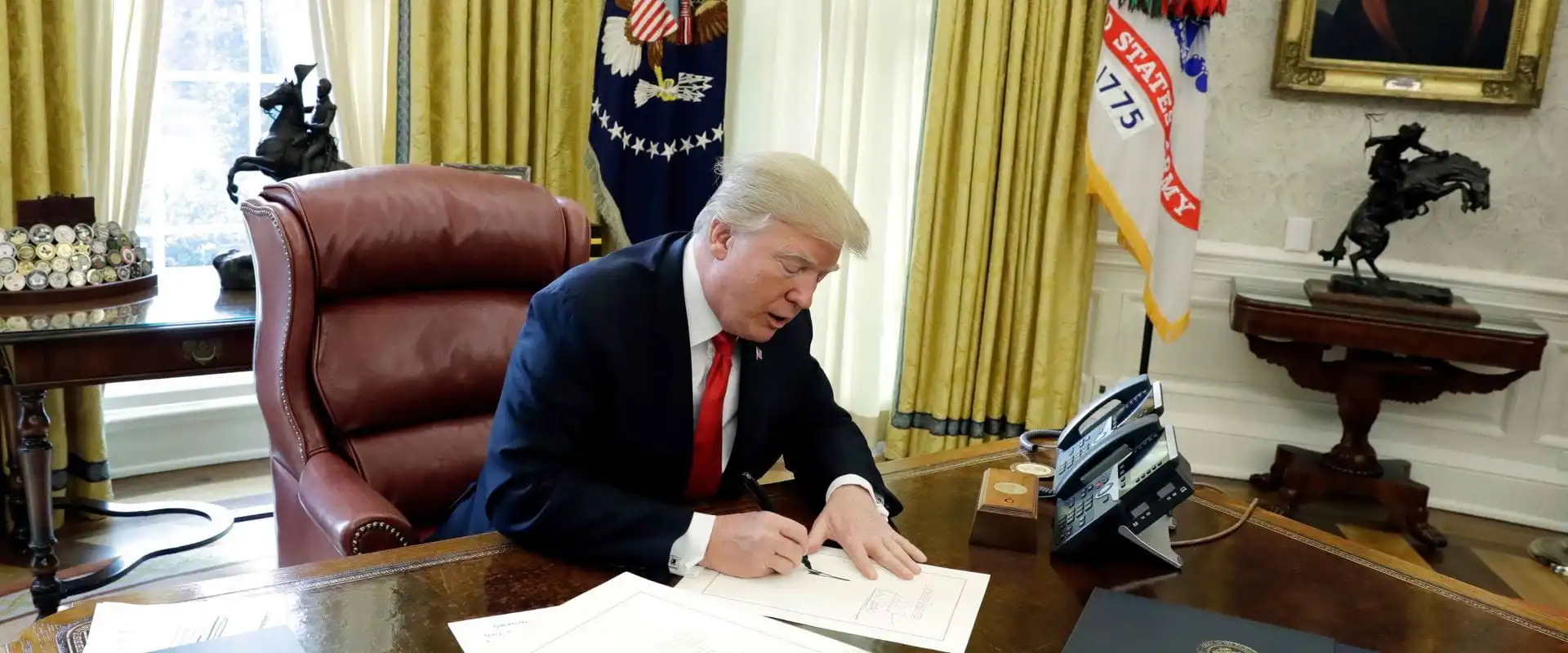

With some of the law’s provisions set to expire, research offers lessons for lawmakers.

“On the downside, taxing business income tends to weigh on the economy. It does so by reducing the incentive to accumulate capital and start new businesses or expand existing ones. That, in turn, lowers national income.”

What the absolute fucking hell what what what!? What kind of insanity is that??

“Taxes are too high so I don’t want to try to earn more money. I’ll settle with less money.” Said literally no capitalist ever.

It’s trickle-down with fancier words.

With some of the law’s provisions set to expire, research offers lessons for lawmakers.

LOLOLOLOLOL.

They will do what they always do. They will double down on the stupid, vote the way Trump tells them to, then blame Democrats when shit goes south, even though they have no power in any branch of government.

Remember, they have gone on record multiple times saying it is the Democrats’ job to save them from themselves.

Of course. Trickle down hasn’t “worked” in the fifty years we’ve been doing it, but it “works” in that it’s an upwards redistribution of wealth – which rich people love. So it’ll continue and even get worse despite “not working”.

They’ve long since given up on it making any sense for broader fiscal conservativism, and any pretense of it actually trickling down to the poor. As a country, we’re now running mask off evil policy and becoming increasingly brazen and proud of it.

Horse and sparrow economics is at least 100 years old or older. And just as long disproven. It didn’t work in the 19th century, the 20th century, and will continue not to function the way they repeatedly claim in the 21st century.

Book number 437 in an ongoing series of how right wing economics is total horseshit that never works.