Calm down, this isn’t the banks screwing the little guy. This number includes tax and possibly insurance — “PITI” (principal, interest, taxes and insurance) is the standard quoted cost. It’s just an estimate. You can often pick your own insurance which will change the cost, and if you’re buying in cash, insurance may not even be required. (It will almost certainly be required if you have a loan, since the bank wants its assets protected.)

What assets? They put 100% down! Haha

No they didn’t. They put 99.99% down. There’s $1 left.

Oh shit I didn’t see that before hahaha

The calculator probably doesn’t think that much when it’s basically supposed to be an ad for a bank

The home insurance covers the home, so it’s useful for all interested parties (owner, possibly bank).

Even if the bank doesn’t have any interest in the house (cash sale/no mortgage), I would absolutely want to insure the house!

Owning a house means you don’t pay rent, but you do have to pay taxes and, unless you really want to gamble, insurance.

That’s not a mortgage though.

Can someone explain this meme to me? If my math is right, the value of that payment stream over 30 years is about $58K at the interest rate mentioned.

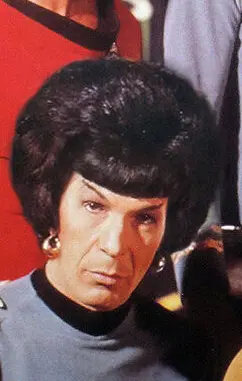

Down payment is set to 100%, so they are essentially buying the house, and their mortgage would be 0$, yet they expect to pay 300$ a month.

I’d say it’s just a calculator error where someone coded the if statement that checks for a zero rather poorly.

Estimate includes property taxes.

And usually home owners insurance since that is usually held in escrow by your mortgage company. This isn’t the meme OP thinks it is

The estimate rounded up from 99.99%. If you look in the bottom left you can see that they put all but $1 down

Most mortgage calculators add in property taxes, insurance, and HOA fees to give a truer cost to potential homebuyers. So, if you are paying all cash, the mortgage calculator is going to give you the additional costs only.

A lot of times, it is paid in escrow to the mortgage company. However, even if the mortgage company isn’t collecting it, it still needs to be paid.

Thanks. But do those costs really add up to around 25% of the house cost? That’s more than I would have expected.

I’ve seen condos where the Strata/HOA fee alone would have been around 25% of the monthly mortgage.

$400 / month strata on a $1600 / month condo. It’s practically thievery, no idea how maintaining and apartment is supposed to cost $4800 a year per person. Can’t remember how many unit but even assuming a low count of 10 units that’s $48,000 a year in maintenance. Seems pretty excessive.

It depends on the area. Both Texas and New Jersey have very high property taxes, so it wouldn’t be that surprising. Or it could be expected insurance costs like in Florida, which could be very high.

Curious where you are getting 25%?

At least this amount will, assuming it’s just taxes and insurance, be due every month for as long as it’s owned. Property taxes in California for example are around 1%/year (so a $377k home would be around $4k/year).

If you own the home outright you may not need insurance, but of course, that’s a risk.

Taxes may be severely limited in how much they increase (see: California prop 13), so while they will likely increase it may not match e.g. rental increases.

Curious where you are getting 25%?

Oh hmm, 18%. $377/m for 30 years discounted at the interest rate mentioned gives $58K which is around 18% of the house price of $323K. My mental math was a bit off.

I see. In this case the 30 years is irrelevant I think.

This is probably PITI cost — principal, interest, taxes, insurance. Principal and interest are zero here, but the other two continue for as long as you own the home (property tax is annual like income tax — it’s not a one-time-deal like sales tax).

It’s not one.

It’s not even a meme.

ITT: people who didn’t actually look at the screenshot

1 waka

For real

Do you need a dollar? I can loan you a dollar!

30-year fixed, 5%

For those of you confused as to why being $1 short of the price would translate to $377/mo… This particular calculator factors in things like property taxes, homeowners insurance, HOA fees, and other recurring expenses that are paid for annually, but are typically deducted into an escrow account each month along with your mortgage payment so that you aren’t hit with a surprise bill for thousands of dollars at the end of the year.

Not a meme ffs

Oh, the content Nazis finally migrated from Reddit

Hurr durr people care about a community not becoming a dumping ground… Don’t waste my time.

That’s just a bug.

It’s not a bug, that number includes property tax and home insurance which is like 99.99% of it

It’s a bug in that if you pay cash for a house, you won’t be paying into escrow for tax and insurance. Banks require that in the vast majority of mortgages.

This is just a simple online mortgage calculator so it factors in escrow into the monthly payment since that’s what pretty much everyone is going to have.

That’s escrow.

deleted by creator

You can always refinance…

So… is any picture a meme now?

That’s actually a decent property tax rate where is this

LOL please remind me again why financial experts advise against paying for a house in one lump sum?

Interest is infuriating. Imagine paying $377 a month for 30 years just to pay off that last dollar you left off at the beginning🤦♀️

Because if you have several hundred thousand dollars laying around to pay in cash, you’re better off investing that into an index fund which will have a higher rate of return than the interest on the mortgage.

If you have $500k and want to buy a $500k house, you could pay the entire $500k down and own the house free and clear, but you would only gain the appreciation on the house if you ever sell it. Assuming doubling in value every 10 years it should be worth $4M after 30 years.

If you had $500k and took out a mortgage of $400k, at the national average of 7% and 30 years, you would pay a total $1,033,654. If you took the other $400k you had and put it in just the S&P 500 which has averaged right at 10% annually, and left it there, you would end up with $6,979,760 in that fund at the end of the 30 years.

So you would come out ahead by about $4 million at the end if you took the mortgage and invested the cash.

Liquidity Risk: Paying in full ties up a large amount of capital in one asset, reducing financial flexibility and liquidity.

Opportunity Cost: The capital used for a lump sum payment could potentially yield higher returns if invested elsewhere. Although, at current rates that is probably unlikely.

Leverage: Mortgages allow for leverage, where you can control a large asset with a smaller initial investment.

Interest Rates: With historically low interest rates, financing can be more cost-effective than using cash. This is currently not true.

Diversification: Investing the money in a diversified portfolio can reduce risk compared to putting it all in a single property. See Leverage.

Tax Benefits: Mortgage interest payments can often be tax-deductible, which is not applicable when buying outright.

Mortgage interest payments can often be tax-deductible, which is not applicable when buying outright.

Okay but if you pay it all off in one lump sum there won’t be any interest payments at all. So both scenarios kinda break even in that regard.

Ah, so it depends if you want to buy a house so you have somewhere safe to live that you can’t be evicted from, or whether you want to use it to destroy society for your own immoral personal profit?

[Edit] Sorry, I’m probably being a bit severe there

Insurance and property taxes are factored into the monthly payment, though it’s not obvious from the meme

Hm. I always assumed insurance is paid separately to the insurance company and property taxes are paid separately to the county.

If you have a mortgage, 99/100 the bank is going to make you pay into escrow for insurance and taxes.

This is just a simple online mortgage calculator so it’s not factoring in that you could just pay those yourself if you’re paying all cash for the house.

They can be or they can be paid through “escrow” and your mortgage servicer will pay them.

Usually sites like these want to show total monthly cost though, so they tend to include estimates for property taxes and insurance in the monthly payments. Whether it gets paid through your mortgage servicer or directly by you doesn’t change much.

It can be paid directly by you, or it can be held “in escrow” and paid by your lender. Ultimately it doesn’t make a difference financially, but it does mean logistically you either are paying one bill vs 3+.

It also comes at the risk that your lender fucking up could result in, best case scenario, a paperwork nightmare and maybe a small fee with your insurance/county/whatever, worst case scenario, the cancellation of a policy you may or may not be able to get back into easily.

Online calculators almost always include, or have an option to include, these costs. In part it’s because that’s the number the bank will use to determine what you qualify for. Makes it much easier to say, “here’s your monthly obligation” and compare that to you monthly income, instead of “here’s your monthly obligation, and here’s your twice-a-year tax obligation.”

The screenshot literally says that the payment is including property taxes and insurance.